Cambrian - modular security layer for Solana ecosystem

Modular versus integrated is perhaps the most debated topic in the field of distributed system design today. Solana, with its integrated philosophy, has witnessed a phenomenal increase in the number of users and applications over the past year. With over than 250 apps, over than 10-20m monthly active users and 200-250m monthly transactions, Solana’s adoption rivals leading Ethereum L2 networks combined. At the same time, Solana’s market capitalization at approximately USD 50 billion is a testament to the amount of economic security backing the network.

Ethereum, on the other hand, is no stranger to competition. Doubling down on its modular approach, the latest community effort to enable restaking of ETH to support auxiliary networks has already amassed an interest of over USD 4 billion worth of ETH. There are already a plethora of Actively Validated Services (AVS’), Liquid Restaking Protocols (LRTs) and LRT aggregators looking to leverage EigenLayer to provide optionality to ETH holders, restakers and protocols alike.

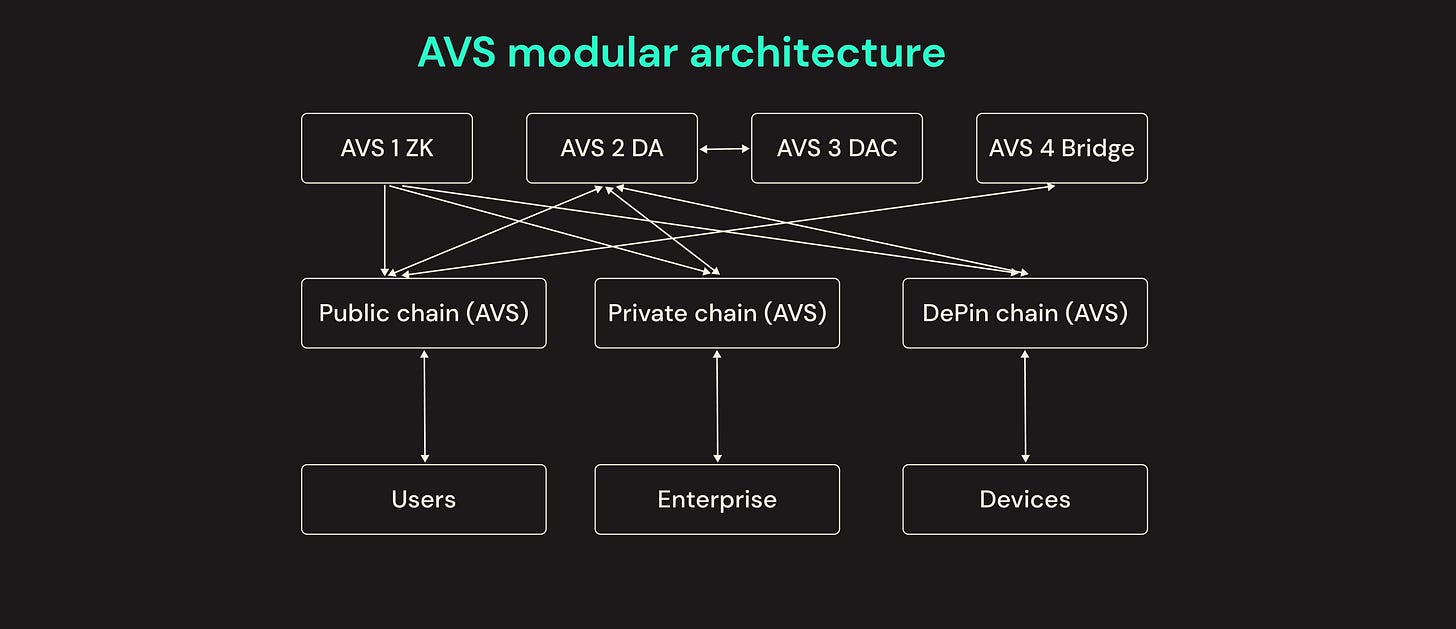

This approach can be compared to the implementation of monolithic and microservice architecture in system design. In microservice architecture the code is divided into separate modules, each function has a separate service. Each software component is designed for a specific function and developers can use separate technology stacks for each service and separate microservices to support separate operations. Also, each service can be deployed, scaled and updated independently, enabling continuous integration and continuous delivery (CI/CD), which is also applicable to the modular architecture that Cambrian's approach enables.

It can be debated as to whether in the long term the modular approach or the integrated one emerge dominant, what’s clear is that in the foreseeable future they coexist. As curious builders, we often wonder whether there are learnings Solana can take from Ethereum and vice-versa. Seems like we finally found one - can enabling restaking a fraction of the $50b of SOL in circulation help Solana ecosystem builders?

Bootstrapping security of decentralized networks is challenging

A range of new sectors including zero-knowledge cryptography, dePIN, artificial intelligence and machine learning have been gaining momentum over the past year. However, all these technologies require professional players (relayers / validators / proovers) who solve tasks specialized for these projects. And we are facing one of the key limitations for the growth of the ecosystem – bootstrapping new middleware networks.

Launching new networks is one of the key and difficult tasks in the development of any on-chain project. Why? Every network is facing the “cold start problem”: gaining users makes the product more useful and sustainable both for validators and other users. But on day 0, there are no paying users on the network and, accordingly, there is no utility for validators. And if there are no reliable validators, then users do not have trust in such a network. This chicken-egg problem usually has been solved by incentivizing early network participants.

The basic idea is: Early on during the bootstrapping phase when network effects haven’t kicked in, provide users with financial utility via token rewards to make up for the lack of native utility. - Chris Dixon (a16z)

Cons of low-trust middleware which creates barriers for innovations:

- Middleware: high cost of capital

- dApps: low trust model

- SOL: low-trusted dApps lower trust in Solana ecosystem, security standards are not unanimous

Pros of sharing trust with SOL:

- Middleware: zero-margin cost of capital, no bottleneck

- dApps: higher core trust from SOL holders and stakers

- SOL: value alignment from new innovations contributing back value to SOL ecosystem and holders

It may seem that the problem is solved. However, early-stage networks’ token is extremely volatile by nature and has weak distribution which makes such networks easy targets for attacks. Another problem that projects are facing during the early distribution period is the death spiral; when a drop in the price of a token reduces the interest of users & validators, making the network less secure and, as a result, even less interesting for participants.

An option is launching a curated model (progressive decentralization playbook), though it also has its own drawbacks: often such decisions lead to the fact that the network remains locked in the hands of the team, never achieving the required level of decentralization.

Introducing Cambrian

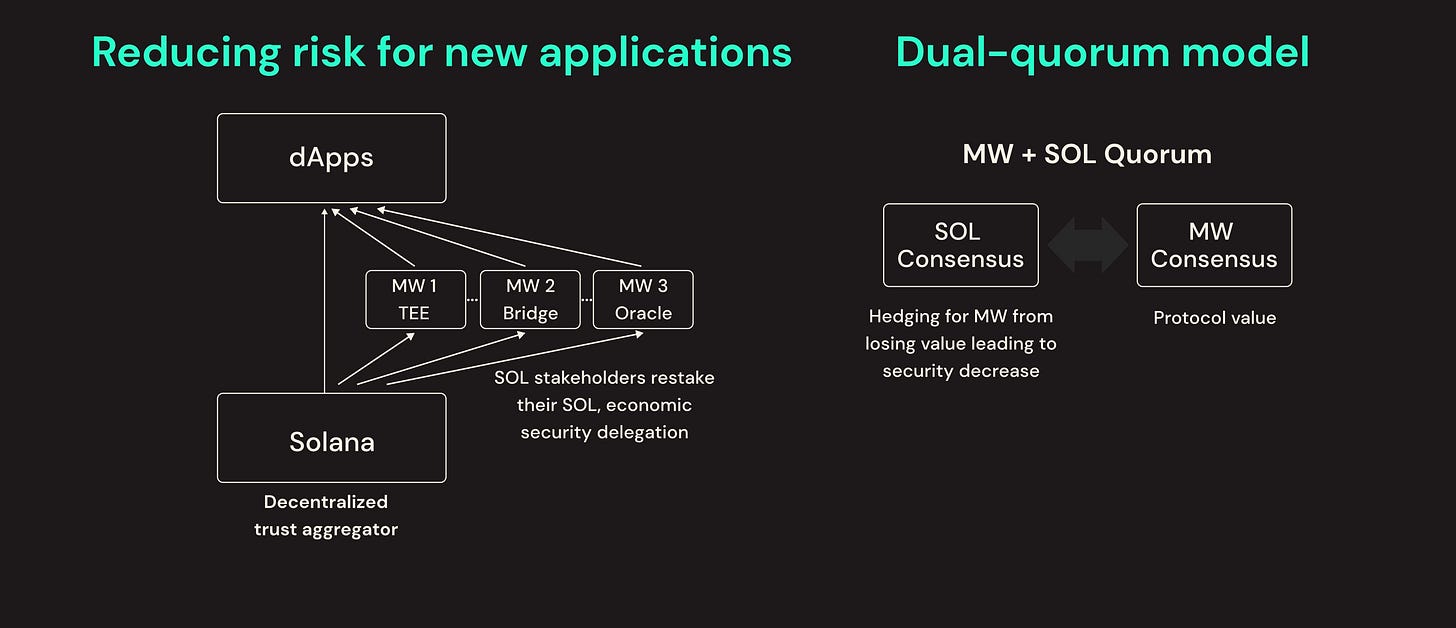

As we can see from above, as the blockchain industry becomes more mature, it is getting clear that there is the need for a security solution that can adapt to and protect a wide range of applications and services. Currently, many dApps rely on additional services that Solana Validators and the Solana Virtual Machine (SVM) cannot provide directly. These required components are known as Middleware. Overall trust in these services is inextricably linked to trust in Middleware. How to bridge this gap?

This is where Cambrian comes into play.

Cambrian creates a novel market for decentralized trust based on the existing Solana consensus turning the capital used for network security into an asset that can be used for other modular networks and middlewares. The model incorporates a restaking mechanism, offering enhanced fee-generating opportunities for both validators and SOL holders. This approach aims to improve features and security of the networks and enrich engagement and financial incentives within the Solana chain.

Benefits

Cambrian benefits users, protocols and the Solana ecosystem at large. Some of the key benefits are listed below.

For protocols:

Attribute security – protocols don't need to run inherently expensive economies with large FDV, instead they can simply rent the economic security of the underlying protocol on a dynamically variable fee based on conditions and requirements.

Reduced cost of developing native solutions to run validators and economic security, allowing more efficient allocation of resources for RnD in other areas.Facilitating the adaptation of developers to specific technology stacks within a particular ecosystem.

More organic implementation of the modular philosophy in the blockchain space without fragmentation across different protocols with complex economic models due to the potential need to handle tokens from different protocols within one standardised modular stack.

This approach also enables various economic models within products on top of Middleware, including developer-targeted tokenomics, where developers can receive a portion of the revenue from all transactions in their products similar to what is implemented in Mode and Archway.

For Solana users:

Value alignment from new innovations contributing back value to the SOL ecosystem and holders.

Reduced transaction costs compared to other modular solutions, Rollups and Subnets, due to a fundamentally different approach to the transaction lifecycle than EVM.

For Solana ecosystem:

More organic implementation of the modular philosophy in the blockchain space without fragmentation across different protocols with complex economic models due to the potential need to handle tokens from different protocols within one standardized modular stack.

Creating entirely new combinations and use cases due to reduced fragmentation of economic security.

Low barrier for starting validating new middlewares and getting additional fees leads to engaging more validators and increasing security of Solana

It is also worth noting the benefit that the entire Solana ecosystem receives from the presence of a modular security layer: dApps leverage trust from consensus layer to construct services for their end users. The equation is simple: simplification of bootstrapping security leads to more innovations for the ecosystem overall, more innovation leads to more users, which in turn builds more trust… Awesome network effect!

A restaking protocol can improve cost-effectiveness not only for projects running on top of AVS, but also for Solana's stakers and validators in long-term planning. At the moment, initiatives such as Solana Foundation's TDS 2022 and Server Program are helping more validators and RPC operators gain access to non-costly Solana-compliant infrastructure through different incentive methods to maintain engagement while direct transaction revenue is still smaller than infrastructure maintenance cost:

Cambrian creates additional revenue streams for validators and stakers, supporting the network economy and incentives for further growth in decentralization with the volume of funds staked. Solana currently has 68% of SOLs staked out of total circulation, and this structure can serve as a robust accumulator for delegating economic security and creating liquid security markets. Especially since the ecosystem around LSD and LRT in Solana is just beginning to develop against the backdrop of the rapid growth of this area in Ethereum.

Potential applications

We foresee a plethora of applications that can benefit from Cambrian’s shared security primitive.

A few of them are listed below:

General decentralized networks: oracles, network keepers, automation.

Coprocessors: Decentralized and economically efficient AI output through economic security, private database information retrieval, zk-coprocessors through verification marketplaces, DeFi circuit breakers

Creating narrow use cases to suit the needs of individual customers: for example, this could be running Middleware with specific requirements such as the ability to partially encrypt transactions and smart contracts with separation into public and private parts. This could be applicable for financial applications, creating MEV-resistance, and even for gaming (creating fog of war, card games).

DePin: Bootstrapping validation networks for complex DePIN infrastructure for usecases with any types of computations, which significantly reduces the cost of creating your own chain and may allow you to compete more effectively with web2 projects in this area..

Cryptography: Threshold FHE, MPC, TEE committees - this opens up a wide range of possibilities, including the creation of permissioned bridges with economically secure validator sets.

MEV Management: Auction, private RPCs, conditional trades

Separately, we would like to mention that a shared modular security model from Cambrian could accelerate a lot of appchain specific use cases by helping to bootstrap validation networks for Solana Permissioned Environments.

Similar to EigenLayer but not really! Cambrian is Solana native

Cambrian’s idea of a modular security layer was inspired by Eigenlayer’s success in the Ethereum ecosystem. However, despite the ideological similarity, the architecture of the solution is fundamentally different due to the different nature of the Solana blockchain from Ethereum:

Completely different stack: it is impossible to make compatible EVM and SVM applications. Though there is a solution to run EVM bytecode on top of SVM (see Neon’s implementation for details), it does not allow you to use the full capabilities of the Solana blockchain.

Solana uses parallel processing in contrast to consecutive Ethereum’s execution, which makes the transaction lifecycle quite different. These differences should be taken into account when designing consensus and slashing mechanisms in different AVS use cases.

Different block building mechanics require different approaches to providing and validating data.

Solana offers a vertical approach with a high TPS, in contrast to the rollup-centric model of Ethereum. As a result, completely different use cases are relevant (for example, those focused on HFT trading infrastructure).

We see other approaches trying to build staking services on Solana:

Picasso: focused on IBC implementation, while we consider Solana-native approach.

Developers of Solana clients: no vendor-lock comparing to restaking solutions that can be built by developers of Solana clients which leads to easier onboarding of middlewares and higher decentralization.

Jito - is a protocol that offers stakers, in addition to the basic yield for LSD, also a yield for MEVs. In particular, Jito Labs has introduced products such as the Jito-Solana Validator Client and Jito Block Engine to become a major provider of Solana MEV infrastructure. Together with solutions such as Jito, Cambrian can enable similar solutions to increase infrastructure resilience and add new usecases.

At Cambrian, we believe in use cases for the mass market and healthy organic co-evolution. However, with the continuous growth in activity and user base, there's a constant need for additional functionality and the ability to scale rapidly. Scaling Solana with the modular shared security approach, in our opinion, is the most optimal way to retain or directly delegate users and liquidity within Solana itself as well as for the impetus for a new round of crypto industry evolution with the emergence of technologies, mechanics and usage scenarios that were previously unavailable.

wen dc ser?